are delinquent property taxes public record

Secured property taxes are calculated based on real propertys assessed value as determined annually by the Office of the Assessor-Recorder. After a municipality issues a tax lien.

Charlotte Foreclosure Notice Sell House Fast Sell House Fast Foreclosures Selling House

Taxes Paid Under Protest To preserve your right to seek a court ordered refund you must comply with requirement of the law RCW 8468020 and WC 45818215.

. The first installment of the annual bill is due on November 1st and becomes delinquent if not paid on or before December 10th. Record Waste Hauler Data. In Texas all property is taxable unless it is exempt by law.

Taxpayers may choose to pay their property taxes quarterly by participating in an installment payment plan. When they purchased the property. This amount must be obtained by contacting the Treasurers office PRIOR to payment.

Property taxes hold more rights in the property than the mortgage. A taxpayers identity the nature source or amount of his income payments receipts deductions exemptions credits assets liabilities net worth tax liability tax withheld deficiencies overassessments or tax payments whether the taxpayers return was is being or will be examined or subject to other investigation or processing or any other data received by. In the case of real property exclusive possession is taken by mailing a notice of delinquent property taxes assessments penalties and costs to the defaulting taxpayer and any grantee of record of the property at the address shown on the tax receipt or to an address of which the officer has actual knowledge by certified mail return.

Pacific Time on August 31You can make online payments 24 hours a day 7 days a week until 1159 pm. Delinquent Real Estate Taxes. The information displayed reflects the.

A tax sale is the forced sale of property usually real estate by a governmental entity for unpaid taxes by the propertys owner. If the delinquency date falls on a. The Champaign County Clerk is the official record keeper of all birth death marriage and civil unions that occur in Champaign County.

Property owners unable to submit their request online must contact our office at 213. If the property owner fails to pay the delinquent taxes within two years from the date of delinquency the tax certificate holder may file a Tax Deed Application TDA per Florida Statute 197502. All property owners are responsible for knowing that their property taxes are due each year.

Who owns the property. The TDA is a legal document that initiates the process of the property to be sold at a tax deed sale conducted by the Clerk Comptrollers Office. Property tax liens are superior to other liens so.

NRS 1161105 Categorization of property in certain common-interest communities. Since leased vehicles produce income from the leasing company they are taxable to the leasing company. Mailing or delivery of notice of delinquent assessment.

These taxes are paid to the city the township or county in which they reside. Property owners typically receive their Annual Secured Property Tax Bills in September. Property tax lien foreclosures occur when governments foreclose properties in their jurisdictions for the delinquent property taxes owed on them.

A mortgage in itself is not a debt it is the lenders security for a debt. The Clerks Office provides a number of other services to the public. View the Code of Ordinances.

Pacific Time on the delinquency date. The Champaign County Clerk maintains delinquent property. Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien.

All property owners are responsible for knowing that their property taxes are due each year. Property Taxes are billed on a fiscal year basis July 1 - June 30 and are payable in two 2 installments. Taxes become delinquent April 1.

Pay my Property Taxes. Address Search by Address through Property Tax Miscellaneous Receivable and Utility Billing Records. Taxes become delinquent April 1.

The secured property tax rate for Fiscal Year 2021-22 is 118248499. Interest of 56 of 1 per month plus 2 penalty must accompany delinquent taxes paid after due dates. The sale depending on the jurisdiction may be a tax deed sale whereby the actual property is sold or a tax lien sale whereby a lien on the property is sold Under the tax lien sale process depending on the jurisdiction after a specified period of time if.

In other words if delinquent property taxes are paid off while property is in a tax deed application status the applicant is reimbursed for their total investment accrued interest and the tax deed sale. If you receive a tax bill from your leasing company that means you signed a contract that requires you to reimburse the company for the taxes on your vehicle. A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan.

A tax lien is a legal claim that a local or municipal government places on an individuals property when the owner has failed to pay a property tax debt. Top 100 Delinquent Taxpayer - This lists the top 100 delinquent taxpayers for the current fiscal year. A Glossary of Property Tax vocabulary is provided for your convenience.

Please contact the Assessors Office 360-378-2172 for further details. About John Drew. Ad Valorem Taxes Latin for according to worth are taxes based upon the assessed value of three types of property.

Including notary DBA various licenses and mobile home registration. Pursuant to California Revenue and Taxation Code Section 2922 Annual Unsecured Personal Property Taxes are due upon receipt of the Unsecured Property Tax Bill and become delinquent after 500 pm. Real estate taxes become delinquent each year on April 1st.

Ad Valorem Taxes Latin for according to worth are taxes based upon the assessed value of three types of property. Property owners affected by the COVID-19 public health crisis must complete and submit a penalty cancellation request online and include a brief statement of how the public health emergency has impacted their ability to make a timely property tax payment. Secured Property Tax bills are mailed in October.

By virtue of the persons ownership of a unit is obligated to pay for a share of real estate taxes insurance premiums maintenance or improvement of or services or other expenses. Tax notices must be issued in the name of the owner of record as the property stood on January 1 of the taxing year. A Glossary of Property Tax vocabulary is provided for your convenience.

Delinquent Taxpayer Publication - This publication lists delinquent taxpayers with prior year delinquent taxes. In order for a city county or township to charge taxes on each property they need to keep a detailed record of every property within its jurisdiction including but not limited to the following information. The property owner may retain the property by redeeming the tax deed application any time before the property is sold at public auction.

Real Property Taxes Delinquent for 3 Years are Subject to Foreclosure RCW 8464050. Even if the property tax is 3000 and the mortgage is 300000 a delinquency on the tax results in a lien that can later result.

:format(webp)/https://www.thestar.com/content/dam/thestar/business/personal_finance/2010/09/07/property_tax_10_things_you_need_to_know/the_take_on_the_taxhike.jpeg)

Property Tax 10 Things You Need To Know The Star

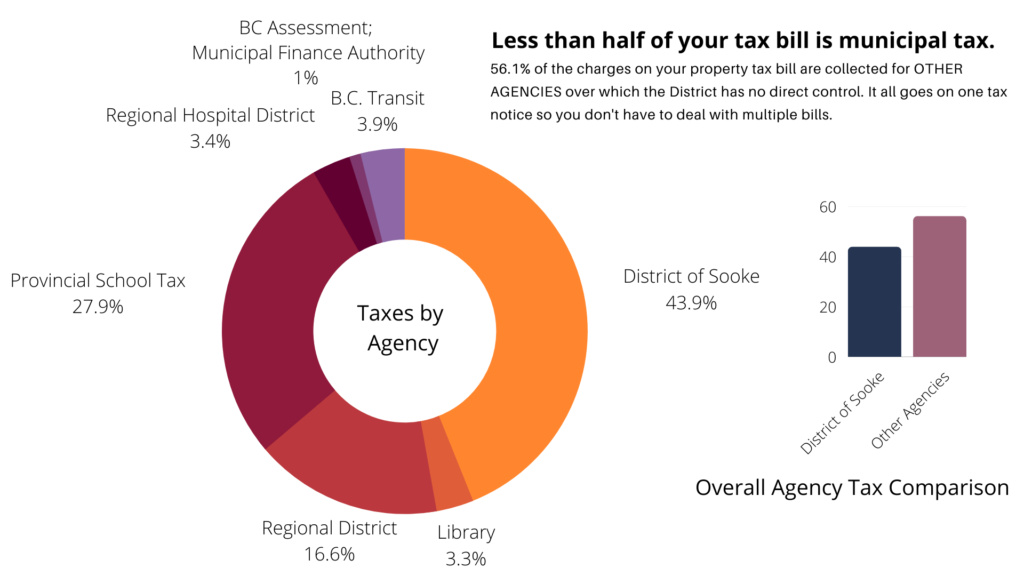

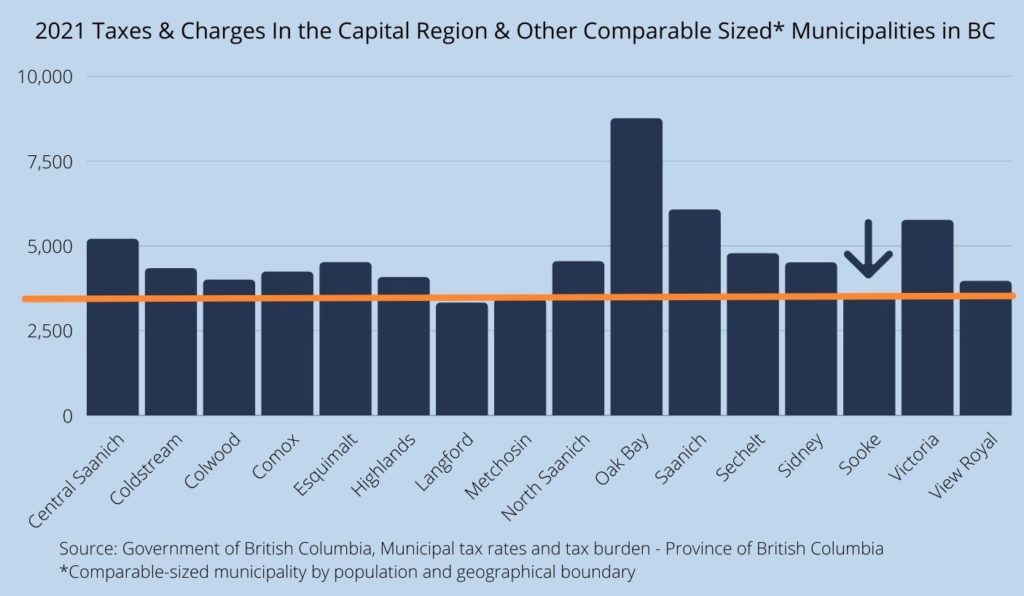

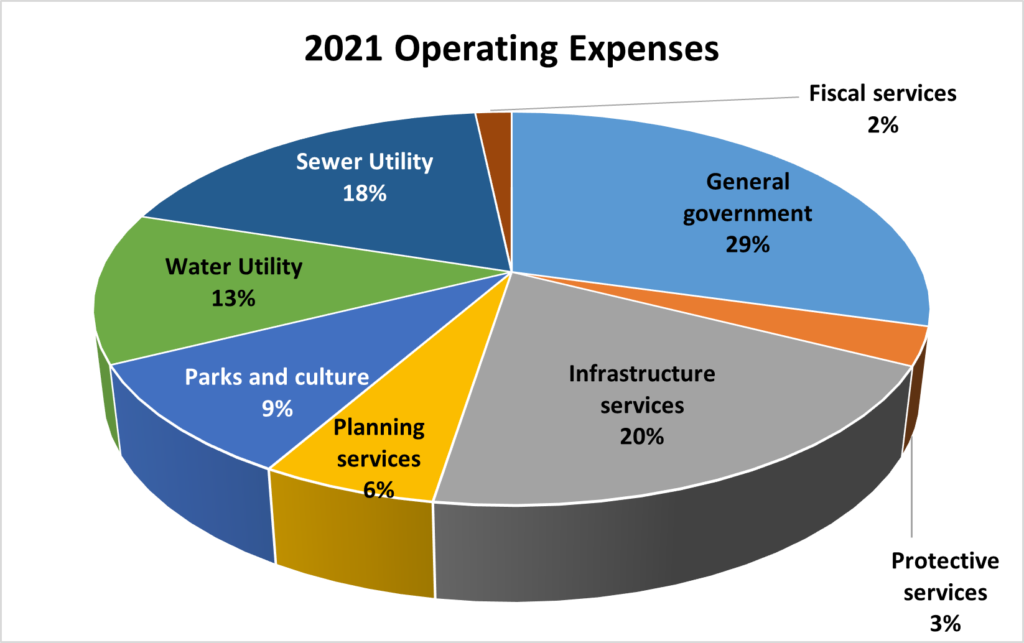

Property Taxes Town Of Gibsons

Pin On Articles On Politics Religion

Frequently Asked Questions Property Taxes City Of Courtenay

P E I Auditor General Flags Tardiness In Property Tax Sales Write Offs Of Unpayable Debt Saltwire

6 Things To Know About Property Titles

How To Find Tax Delinquent Properties In Your Area Rethority

Property Taxes Town Of Gibsons

P E I Auditor General Flags Tardiness In Property Tax Sales Write Offs Of Unpayable Debt Saltwire

How To Find Tax Delinquent Properties In Your Area Rethority